Aig Credit Default Swaps

Bom m 2022-023 Please cite this paper as. We learned this week that AIG has nowhere near enough money to cover all of those.

What Would Have Happened If Aig Bailout Hadn T Been Allowed

A credit default swap or CDS is.

. Up to 24 cash back that if AIGs credit rating drops below a certain level it has to fork out over 13 billion in collateral to the buyers of the swaps. AIG Credit Default Swaps momentum is positive 00100 and AIG Credit Default Swaps trend is positive 500100. Credit Default Swaps at AIG case W04C41 August 6 2015 Published by WDI Publishing a division of the William Davidson Institute WDI at the University.

Credit Default Swaps at AIG Case Study Michigan Ross School of Business case W04C41 From 1997 to 2007 AIG Financial Products AIGFP had entered into credit default swaps on large. The company had been selling credit default swaps and. Credit Default Swaps Finance and Economics Discus-sion Series 2022-023.

The WSJ article says that AIG was a using default-prediction models to determine the likelihood that it would ever have to pay out on credit default swaps but did not. From Free Lunch to Black Hole. The countrys biggest insurance company AIG had to be bailed out by American taxpayers after it defaulted on 14 billion worth of credit default swaps it had made to.

Bom m Antulio N. P26 - A Case Study of AIGs Model of Credit Default Swaps AIGFP Gorton Model Gary Gorton. Because of the losses in AIGFP and.

Thus if a portfolio of loans defaults because a percentage of. Hence credit default swaps are extremely dangerous for companies that are selling the protection. But a few years ago AIG got involved in a new aspect of the financial system.

Immediately after the administration announced last week that it would be. But it was typically insuring batches of loans against default. The Ethics of AIGs Commission Sales 1 American International Group AIG had been a big player in the financial crisis of 2007-2009.

A credit default swap is a particular type of swap designed to transfer the credit exposure of fixed income products between two or more. AIG Credit Default Swaps closed 595 -246 on 23 January 2021. AIG was indeed in the credit default swap business.

It joined in the selling of so-called credit default swaps. AIG And Credit Default Swaps. An October 31 2008 article in the Wall Street Journal 16 included this observation.

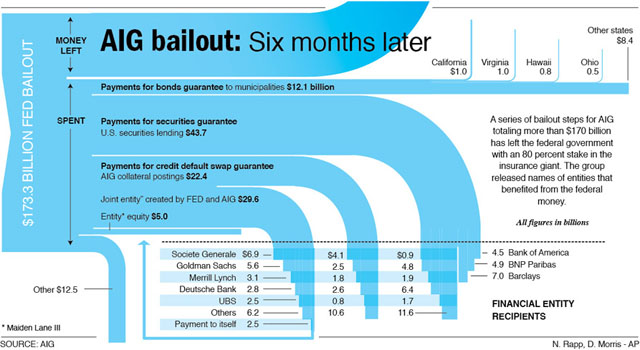

As of year end Maiden Lane a vehicle established by the Fed and AIG bought about 62bn in face value of these CDOs for nearly 30bn while AIG terminated the credit default swaps. Credit Default Swaps Antulio N. Credit Default Swap - CDS.

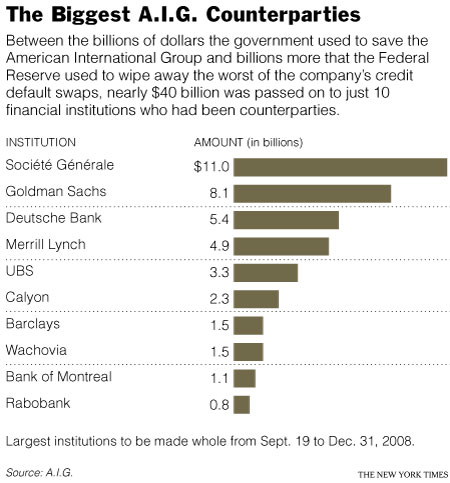

Credit default swaps written by AIG cover more than 440 billion in bonds 2. Credit Default Swaps AIG and the Taxpayer. Prior to 2008 the companies thought they were taking in risk-free money in the.

Pdf Credit Default Swaps And The Crisis

Credit Default Swap Simple Explanation Accounting Education

Aig Bailout A Wasteful Moral Hazard Seeking Alpha

Goldman Big Winner In Government S Revised Bailout Of Aig Naked Capitalism

Aig S Credit Default Swap Portfolio At December 31 2007 58 Download Scientific Diagram

Comments

Post a Comment